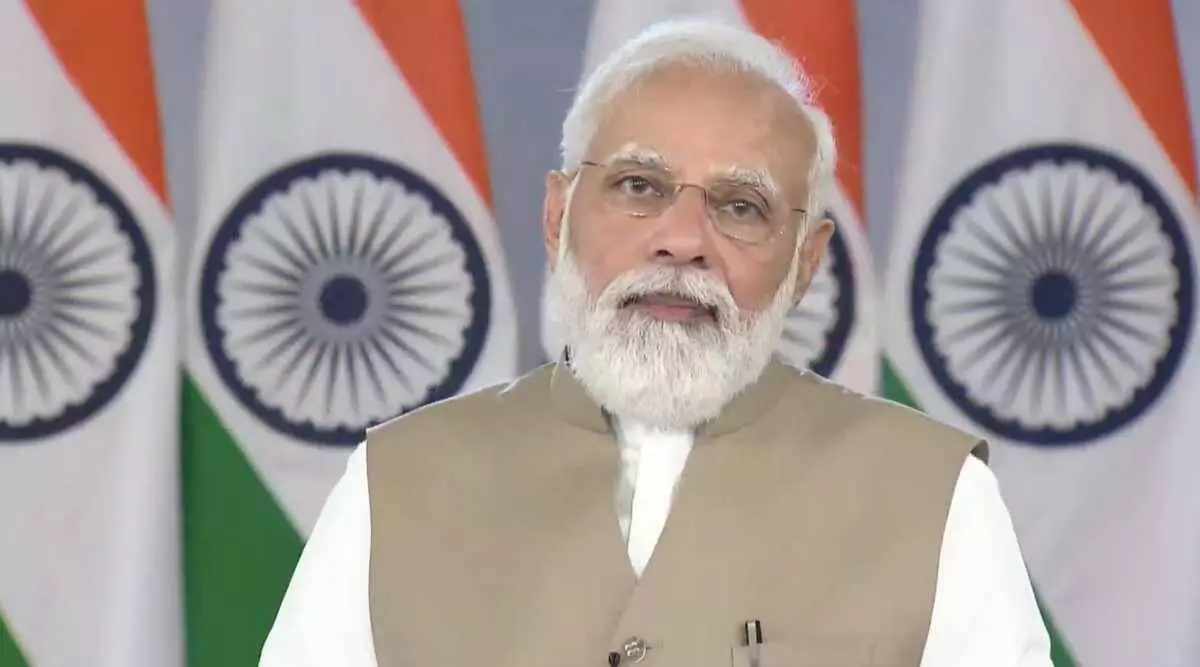

Prime Minister Narendra Modi on Friday launched the RBI’s Integrated Ombudsman Scheme for redressing the grievances of bank customers in the country and Retail Direct Scheme which will enable small investors to buy government securities directly.

The Prime Minister said the One Nation, One Ombudsman System has taken shape in the banking sector with the Integrated Ombudsman Scheme. One of the biggest touchstones of any democracy is the strength of its grievance redressal system. The Integrated Ombudsman Scheme will go a long way in that direction, he added.

PM Modi explained that the Retail Direct scheme will give small investors in the country a simple and safe medium of investment in government securities. It will expand the scope of investment in the country and make access to capital markets easier and more secure for investors.

The Prime Minister emphasized the citizen centric nature of these schemes.

Similarly, the Retail Direct Scheme will give strength to the inclusion of everyone in the economy as it will bring in the middle class, employees, small businessmen and senior citizens with their small savings directly and securely in government securities. As Government securities have the provision of guaranteed settlement, this gives assurance of safety to the small investor, he said.

The Prime Minister said that in the last 7 years, NPAs in banks were identified with transparency, the focus was on resolution and recovery, Public Sector Banks were recapitalized, one after the other reforms were carried out in the financial system and public sector banks.

Also read: PM Modi inaugurates Kushinagar airport as Sri Lankan flight lands with Budhist monks & ministers

To further strengthen the banking sector, cooperative banks were also brought under the purview of RBI. Due to this the governance of these banks is also improving and the trust in this system is getting stronger among the depositors, he added.

He said in the past few years, in the country's banking sector reforms ranging from inclusion in the financial sector to technological integration have been carried out. “We have seen their strength in this difficult time of Covid. The decisions of the RBI also helped in increasing the impact of the big decisions that the government has taken in recent times”, he said.

The Prime Minister said till 6-7 years ago, banking, pension and insurance, used to be like an exclusive club in India. All these facilities were not accessible to the common citizens in the country, poor families, farmers, small traders-businessmen, women, Dalits-deprived-backward, etc.

Criticizing the earlier system, He said those who had the responsibility of taking these facilities to the poor never paid any attention to it. Rather, various excuses were made for not changing. It was said that there is no bank branch, no staff, no internet, no awareness, no idea what the arguments were, he lamented.

The Prime Minister said UPI has made India the world's leading country in terms of digital transactions in a very short span of time. In just 7 years, India has jumped 19 times in terms of digital transactions. Today our banking system is operational 24 hours, 7 days and 12 months anytime, anywhere in the country, he added.

The Prime Minister praised the Finance Ministry and institutions like RBI for their efforts during the pandemic. “This period of Amrit Mahotsav, this decade of the 21st century is very important for the development of the country. In such a situation, the role of RBI is also very important. I am confident that Team RBI will live up to the expectations of the country”, he added.