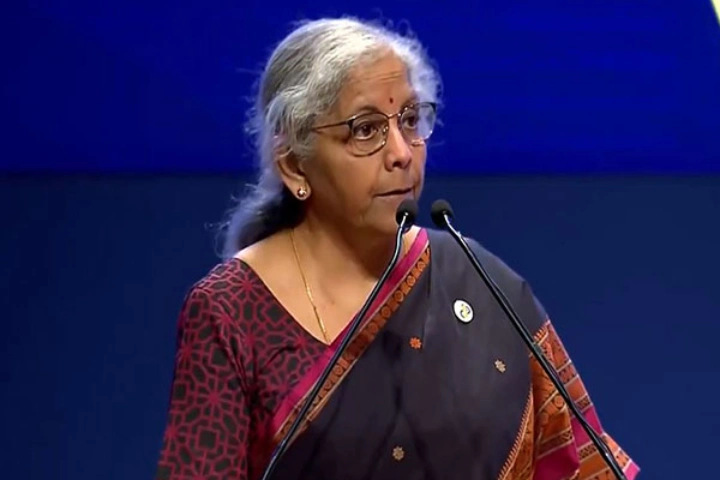

Finance Minister Nirmala Sitharaman on Monday said that measures taken for monetary tightening has stabilised yields of government securities, which has contributed to the overall financial market resilence in investor confidence in the Indian economy.

Addressing an event to commemorate 90 years of the Reserve Bank of India, Sitharaman said, “Fiscal and monetary policy coordination, has always been the government policy… India is one of the governments like very many others and RBI manages its debt, which is very important for government.”

“Inflation management despite monetary tightening pressures and the measures which has been taken for monetary tightening has stabilised the G-sec yields which are very important for the economy. The stability at G-sec markets has contributed to overall financial market resilience and investor confidence in the Indian economy” the Finance Minister said.

Sitharaman commended RBI’s steadfast commitment to safeguarding India’s financial interests and reiterated the government’s support for the institution.

Highlighting the global recognition of RBI’s contributions, Sitharaman referenced the Bank of International Settlements’ acknowledgment of RBI’s role in anchoring inflation expectations through effective communication policies.

She reiterated the importance of such unconventional measures in maintaining macroeconomic stability and fostering sustainable growth.

“The Bank of International Settlements (BIS) has mentioned the significant role played by RBI. In a very unconventional point RBI’s role in anchoring inflation expectations using communication policy is significant is what the BIS has said,” the Union Finance Minister said.

In her keynote address at the ceremony held in Mumbai, Sitharaman acknowledging RBI’s pivotal role in navigating India through formidable economic storms.

Sitharaman reminisced on RBI’s illustrious history, characterizing it as a saga of resilience amidst diverse challenges.

She highlighted the unparalleled response of the RBI during the COVID-19 pandemic, commending its adept use of both conventional and unconventional policy instruments to ensure liquidity, foster growth, and uphold financial stability.

“RBI, the central bank of India had a remarkable chequered history. Once in a century, pandemic the Covid hit us. The RBI adopted and in fact deployed conventional and unconventional range of instruments to provide liquidity and to promote growth and to ensure financial stability.”

She said, “The two examples that I can site and which can stand before as a classic example are the moratorium on the loan payments and also the liquidity infusion which happened during that time. Later came the Russia Ukraine war. RBI’s measures primarily aimed the two things. One to address the inflation and forex market volatility. RBI infact has been one of the earliest to recognise the non-transient nature of the inflation.”

The Finance Minister also threw light on RBI’s strategic interventions during the Russia-Ukraine conflict, emphasizing its efforts to address inflationary pressures and stabilize forex markets.

She lauded RBI’s foresight in recognizing the persistent nature of inflation and its timely policy adjustments to mitigate its impact.

Sitharaman underscored the central bank’s pivotal role in managing India’s external imbalances and uncertainties, citing the institution’s proficient forex reserve management and effective supervision of the banking sector.

She hailed the transformation of India’s banking sector from a decade-old balance sheet problem to a current balance sheet advantage, attributing this progress to RBI’s astute oversight and regulatory measures.

Finance Minister said, “One of the few central banks if I may say so to frontload policy rate, hikes in particular, Forex reserve management is also something on which we have this opportune moment to recall the work done by the RBI. Building up reserves, including foreign interventions.

She further said, “In the past few years, India’s capacity to manage and also to take care the external imbalances and uncertainties have significantly improved purely because of the professional management of the RBI. Rupee has exhibited lower volatility and orderly movements what we noticed of the rupee and they are in relative terms of their peers.”

“Managing India’s banks is something which I will recall at this time. A decade ago balance sheet problem today is the balancesheet advantage and that advance is accrues to our economy,” Sitharaman said.

Established in 1935, RBI functions as the nation’s central bank, following the recommendations of the Hilton Young Commission and governed by Reserve Bank of India Act, 1934.

Its primary responsibilities encompass regulating the issuance of banknotes, maintaining reserves to ensure monetary stability, and managing the credit and currency system of the country.

Established in 1935, RBI functions as the nation’s central bank, following the recommendations of the Hilton Young Commission and governed by Reserve Bank of India Act, 1934.

Its primary responsibilities encompass regulating the issuance of banknotes, maintaining reserves to ensure monetary stability, and managing the credit and currency system of the country.

The Central Office of the Reserve Bank was initially established in Kolkata but was permanently moved to Mumbai in 1937. The Central Office is where the Governor sits and where policies are formulated.

Though originally privately owned, since nationalisation in 1949, the Reserve Bank is fully owned by the Government of India.