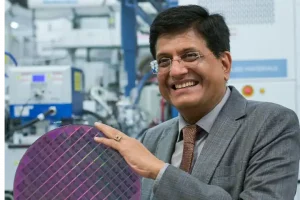

Commerce and Industry minister Piyush Goyal said on Thursday that India has the highest FinTech adoption rate in the world at 87% compared to the global average of 64%.

The Fintech adoption rate shows the percentage of digitally active people in a country who use fintech services.

Addressing the 2nd Global Fintech Fest-2021 through video conferencing the minister said, “India is today one of the fastest growing Fintech markets with more than 2,100 FinTechs.”

“A lot of Indian Fintech startups are unicorns (valued above 1$billion) and India’s market is currently valued at $31 billion, and expected to grow to $84 billion by 2025,” he said.

“Investment inflow in the Fintech sector has gone up to $10 billion since it started in 2016. It has a huge potential to “Up the Game” and will simultaneously enhance customer experience,” Goyal pointed out.

Also read: PayU to acquire homegrown Billdesk for $4.7 bn

“As of May 2021, India’s United Payments Interface (UPI) has seen participation of 224 banks and recorded 2.6 billion transactions worth over $68 billion and the highest ever, more than 3.6 billion transactions, in Aug’21,” the minister said.

“Over 2 trillion transactions were processed using the AePS (Aadhar-enabled payment system) last year,” he added.

Goyal said India’s FinTech industry came to the rescue of people at the time of the coronavirus pandemic, by enabling them to carry out critical activities from the safety of their homes, particularly during the lockdown and the 2nd Covid-19 wave.

Goyal said more than 2 crore accounts had been opened under the Prime Minister’s Jan Dhan Yojana, since it was launched on 15th August 2014, which has been considered a world record.

An interesting development is the emergence of embedded finance

The non-financial services sectors are also proactive in adopting FinTech solutions today.

The minister said that with the expansion of their value chains, fintech services will grow proportionally.

“Our MSMEs have also rapidly adopted FinTech solutions whether for credit, payments, accounting & tax filing. Government has recently launched the Open Credit Enablement Network (OCEN) & Account Aggregator (AA) framework. These enable formal credit flow to the most vulnerable segments, especially particularly small businesses, brings Ease for financial institutions to reach large segments, by lowering distribution costs and now institutions can give smaller loans, with short repayment cycles, the minister explained.