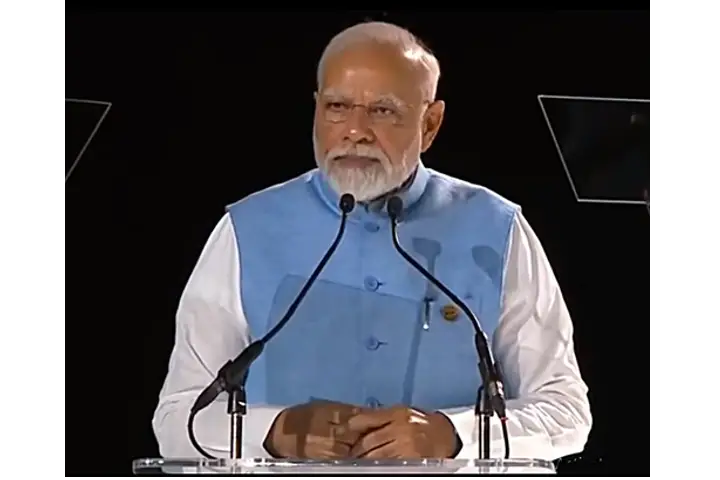

Prime Minister Narendra Modi’s assertion at the BRICS Business Forum that India is poised to touch the 5 trillion economy mark very soon and that the country will be the world’s growth engine in the coming years did not come as a surprise to the global community.

“Despite a shaky world economy, India has emerged as the world’s fastest-growing major economy. India will soon become $5 trillion economy,” Modi said.

Driven by a host of reforms, a push for infrastructure, robust domestic demand along with a ready labour pool, India’s economy is likely to remain resilient. Most analyses done by domestic as well as international thank tanks and agencies have indicated that India’s growth story is here to stay.

The State Bank of India’s Ecowrap, an analysis of the state of economy, has pegged India’s growth rate in the first quarter (April-June) of the current financial year at an impressive 8.3 per cent.

S&P Global, in its recently released report, noted that after rapid economic growth of 7.2 per cent in 2022-23, India’s economic momentum owing to domestic demand, has remained strong in the first half of 2023. Not only did the country’s steel production increase by 11.9 per cent year on year during the April-June quarter, consumption of the metal too rose by 10.2 per cent.

It added that the sustained foreign direct investment (FDI) inflow into the country has helped. Not only has the inflow reduced India’s external account vulnerability amid global uncertainties but has added to the foreign exchange kitty.

Importantly, according to the World Bank, India which is aiming to touch the high middle income status by 2047, has also made remarkable progress in reducing extreme poverty.

“India gets a lot of its GDP from domestic consumption. So even if the world would slow down for a few months, India has a natural cushion by the fact that it is more domestic consumption oriented,” World Bank President Ajay Banga, said.

Banga earlier said that he is “more optimistic about India today as a whole” than he has been in a long time.

Many countries and multinational companies are looking at investing in India as well as part of their China Plus strategy in the post Covid phase. A host of schemes such as the PM Gati Shakti, Production Linked Incentive, Make in India, have helped.

Apple Inc’s top boss Tim Cook, who visited India earlier this year, said India is a focus market for the company.

“India is an incredibly exciting market. It’s a major focus for us,” he said, adding that the country is at a tipping point. Cook added that the vibrancy in India is unbelievable.

Similarly, the Japan External Trade Organisation (JETRO) in December, 2022 revealed that more than 72 per cent of the Japanese companies were keen to expand their operations in India. For China, the number was small at only 33.4 per cent.

India’s growing middle class is a force to reckon with. The increase in the middle class will drive consumption in both urban and rural areas. According to a Brooking report, India’s consumer class growth will be among young people while China will predominantly add consumers above the age of 45. By 2030, India will be home to 357 million young consumers below 30 years, the largest “young consumer market” in the world, it said.

A report released by Goldman Sachs also highlighted that India, driven by a large pool of talent and working age population, is poised to become the second largest economy by 2075, beating the US, Germany and Japan.

Challenges

However, India needs to remain cautious. Its inflation has inched upward. That apart the borrowing costs have remained high as well.

Growth-oriented reforms will need to be accompanied by an expansion in good jobs that keeps pace with the number of labour market entrants, the World Bank added.

Also read: India in a sweet spot, rising middle class will power growth over the long haul