As insolvency and bankruptcy gains more prominence, there is a need for uniform structure of qualification, entry norms, experience, a model code of conduct, penal consequences and inspection norms for the valuation process.

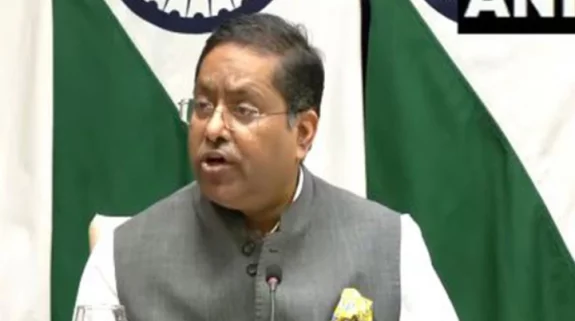

“It is the time for consolidation of the profession, all of the stakeholders have to join their hands together and work towards of the progression of the profession i.e. it has to be recognised by everybody including all classes of users,” Pawan K. Kumar, executive director, Insolvency and Bankruptcy Board of India (IBBI) said in an Assocham function.

Kumar added that the valuation professionals need to keep themselves updated, because everywhere there is a regulation of the profession, besides, setting up some kind of valuation standards.

Allaying the concerns about penal consequences, Kumar said, “Let me assure you that it is very categorically written in the bill that for all valuations done by the valuers there is a presumption of bonafide, however, if a complainant is able to produce evidence that there is a malafide, only then it will follow due procedure laid down under the draft bill.”

Former Reserve Bank of India governor Raghuram Rajan speaking at a webinar hosted by Princeton’s Bendheim Center for Finance, said that the existing model of the bankruptcy, under which even viable companies are auctioned off instead of debt renegotiation may not be a solution. He said there was need to look at the process of debt renegotiation as well to make the system work, especially in the wake of the coronavirus pandemic..