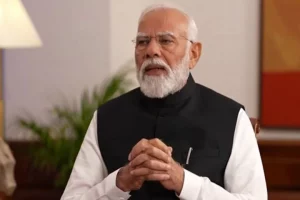

Indian stock indices continued their rally, reaching yet another fresh lifetime high on Monday tracking strong global market cues, hopes of Prime Minister Narendra Modi’s comfortable return to office, besides other strong macroeconomic fundamentals.

At 9.19 am, at the time of filing this report, Sensex was 0.2 per cent higher at 75,585 points, after touching an all-time high of 75,679 points soon after the opening bell.

Similarly, Nifty too remained around its all-time high of 23,000 points.

In the weekly note, Ajit Mishra, SVP, Research, Religare Broking Ltd., expected the Nifty to move towards the 23,150-23,400 range soon.

“While all key sectors are contributing to the rally, banking and IT still have significant upside potential, and their participation could drive the index to much higher levels, Mishra added.

He further recommends continuing a stock-specific trading approach, with a preference for large-cap and large mid-cap stocks for short-term trades.

Indian stock indices last week had a stellar bull run, defying the latest slump in global markets. The consistent bull run in Indian stock indices – Sensex and Nifty — continued and touched fresh highs on Thursday, reacting to Prime Minister Narendra Modi’s assertion that the BJP-led alliance is on track to form the government for a record third term. Also, RBI’s Rs 2.1 lakh crore dividend to the government played its part in refuelling the rally.

With the six phases of elections now behind us, it is widely expected by investors that the Narendra Modi-led government will come back to office with a comfortable margin for his third term. This also likely triggered fresh stock buying.

In the past two weeks, Sensex jumped about 3,600 points, on a cumulative basis.

Overseas investors have been remaining net sellers of Indian equities for the past several sessions. Interestingly, domestic institutional investors during the same period stayed net buyers, largely making up for the outflows by the foreign investors.

By creating an unprecedented wealth of USD 1 trillion in just 6 months, both indices of the Indian stock market BSE and NSE have joined the exclusive USD 5 trillion club, defying the FII (Foreign Institutional Investors) pullout before the outcome of the Lok Sabha election on June 4.

“Overall, we expect the market to witness a gradual up-move and see some volatility next week as both the election and earning season are nearing the end, opined Siddhartha Khemka, Head of Retail Research, Motilal Oswal Financial Services Ltd.

The market will now track exit poll estimates and fourth-quarter GDP figures later this week.

India’s GDP grew at a massive 8.4 per cent during the October-December quarter of the financial year 2023-24, and the country continued to remain the fastest-growing major economy and is poised to maintain its growth trajectory going ahead.