India’s less discussed poultry industry, despite being the fifth largest in the world, has failed to hit headlines. While the annual growth in agriculture crops is estimated at about 2 per cent, growth in this sector is about 10 per cent. But at a time when domestic consumption is set to rise – especially with 70 per cent of Indians remaining protein deficient– challenges have come up. Acute shortage of manpower and rising labour cost have hit the segment leading to demand for increased automation and modernisation. The Covid 19 pandemic also led to several restrictions and lockdown that impacted production in the sector.

India’s poultry meat production was estimated at 4.34 million tonnes as on March 2020, contributing more than 50 per cent of the total meat production. India’s egg production stood at a whopping 114.38 billion, the same year.

Also read: How India can play a key role in supporting world food security

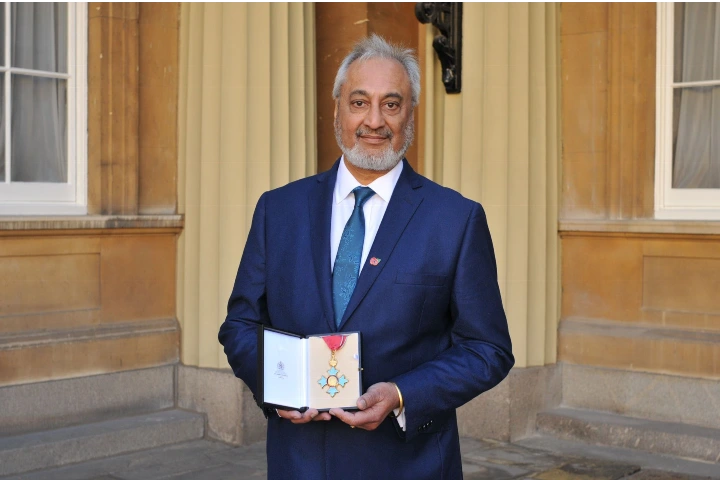

“As demand for poultry products is rising at a very fast pace, policy framework is important to facilitate adaption of automation process for ensuring efficient production system and improving infrastructure at the existing wet market,” Ricky Thapar, treasurer, Poultry Federation of India, told India Narrative.

Majority of the farms in India do not have climate control system, exposing the broilers to various temperature changes, which in turn may impact productivity.

Price of soybean meal, used as birdfeed has also skyrocketed which has made things worse for the estimated six million poultry farmers.

In September, average prices for soybean meal shot up to Rs 84,000 — $1,135 per metric ton — 113 per cent above the government’s minimum support price (MSP) of Rs 39,500 or $531 per MT.

“It is essential to maintain prices to be able to sustain,” Thapar said.

Soybean meal imports, authorized in the amount of up to 1.2 million metric tons (MMT) through January 31, 2022, will help to lower animal feed costs in India, bringing down production costs to more manageable levels with the expectation that savings will be passed onto consumers in the form of lower poultry prices, the Agricultural and Processed Food Products Export Development Authority (APEDA) said.

Exports

According to APEDA, India exported 2,55,686.92 MT of poultry products worth Rs 435.53 crore– $58.70 million — to the world in 2020-21. Globally, India is the 18th largest exporter.

Also read: 70% want MSP for milk, fruits, eggs

While Oman, Maldives, Indonesia, Vietnam and Russia besides several countries in Africa were the main export markets, the poultry industry is now looking to expand its base.

The government must look at policy measures that help in bringing in climate-controlled farm houses and automated feeding lines to the productivity in farms. Feeding, water supply, temperature and humidity control are some of the variables that require automation in poultry farming, Thapar said.

Dublin-based business and market analysis platform, Research and Markets said that the segment will grow at over 15 per cent between 2021 and 2026.

The research platform noted that broiler meat in the past, which was considered a delicacy, is now becoming a staple with increasing levels of urbanization and higher levels of disposable incomes. “Further with changing food habits and increasing exposure to global cuisines, the Indian population is increasingly converting to a non-vegetarian diet,” it said.