China’s factory output further contracted in October mainly due to stricter environmental norms, acute power shortage and an increase in raw material prices.

The official purchasing managers’ index (PMI) for manufacturing activities– a direct reflection of the trends of economic trends in the sector stood at 49.2, lower than what economists had expected, after registering 49.6 in September. In August it was 50.1.

A reading below 50 is taken as a contraction.

Now the reimposition of a strict lockdown at a few provinces to contain the resurgence of Covid 19 is set to further dent economic activities.

Reuters said that China's sprawling manufacturing sector has steadily slowed this year, with output in September growing at its most feeble pace since March 2020.

Also read: China's economy faces a time bomb–its slow birth rate

What may worry Chinese policymakers more is the rising debt levels. The default of the country’s real estate major Evergrande Group is a signal that the world’s second largest economy could take longer to recover.

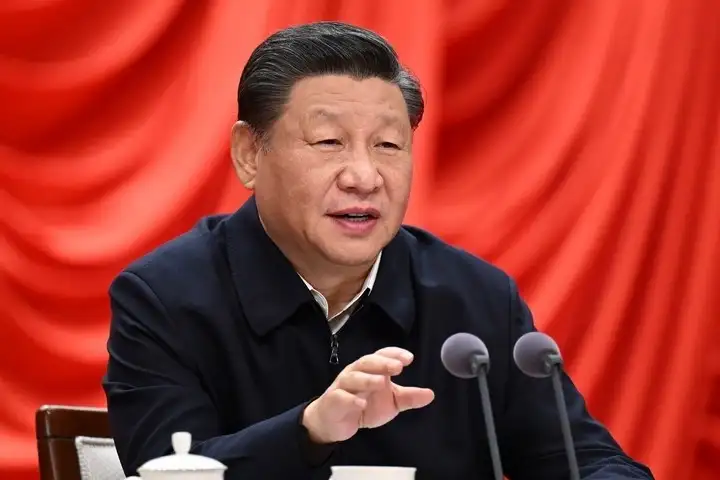

Chinese President Xi Jinping’s call for Common Prosperity has also dampened investors’ sentiments. This along with an ageing population is likely to impact overall consumption.

“China’s overall debt which includes household, corporate and government loans are at an alarmingly high level. This is even more concerning due to scarcity of data and information, so it is not easy to assess the real situation,” Dk Srivastava, chief policy adviser, EY India told India Narrative.

An International Monetary Fund blog in 2017 noted that “rapid growth in household debt – especially mortgages – can be dangerous.”

“In the short term, an increase in the ratio of household debt is likely to boost economic growth and employment, our study finds. But in three to five years, those effects are reversed; growth is slower than it would have been otherwise, and the odds of a financial crisis increase. These effects are stronger at the higher levels of debt typical of advanced economies, and weaker at lower levels prevailing in emerging markets,” the blog notes.