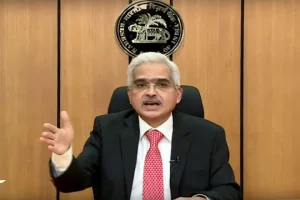

Amid increasing inflation, the Reserve Bank of India unexpectedly hiked policy rates by 40 basis points to 4.4 per cent along with a 50 basis points hike in the cash reserve ratio—the minimum amount of deposit that commercial banks need to hold as reserves with the central bank. The CRR now stands at 4.5 per cent. The increase in policy rates marks the beginning of the withdrawal of the easy money regime rolled out since the outbreak of the Covid 19 pandemic in 2020.

The move has come just ahead of the anticipated rate hike from the US Federal Reserve.

“While we were expecting the reversal of accommodative interest rate cycle from June in phases, the decision of the RBI Monetary Policy Committee to advance the withdrawal of the pandemic-related accommodation have become inevitable in the face of a fast -changing geo-political situation, volatility in crude oil prices and a high level of global inflation not seen in over four decades in large economies like the US," Deepak Sood, Secretary General, Assocham said.

“The unexpected move to increase the repo rates by 40 bps is largely to keep the rising inflation in check. The geopolitical tensions have had a huge impact on crude oil prices, leading to high inflation,” D.R.E Reddy, CEO and Managing Partner, CRCL LLP noted.

Also read: Modi govt won’t cut fuel prices as money needed for social welfare and Infra projects

RBI lowers India's growth projection to 7.2% from 7.8%, focus now shifts to managing inflation