The Pakistani rupee, which depreciated by more than 16 per cent this year, has been the worst performing currency in Asia amid deepening economic crisis and dwindling foreign exchange reserves. On January 1, the PKR was pegged at just over 174 to a US dollar. At present, it has touched a record low of over 212 to a dollar as the negotiations with the International Monetary Fund (IMF) for a bailout package are taking time to conclude.

The IMF had expressed concerns over the country’s 2022-23 budget that was unveiled earlier this month. Though after the IMF nudge, fuel prices have been hiked and subsidies removed, issues related to a widening current account deficit and the direct tax rates remain. That apart, in June, ratings agency Moody’s too downgraded the country’s outlook from “stable” to “negative”, citing the negative impact of high commodity import bills on current account balance.

While Islamabad has imposed a ban on imports of non essential goods, recently it also asked people to consume less tea.

Last week, Pakistan decided to further increase fuel prices by a whopping 29 per cent to adhere to the IMF mandate. The move has infuriated the common Pakistanis as well as his own party members.

In May the annual inflation in Pakistan stood at 13.8 per cent. But the increase in fuel prices will push inflation further in the coming months, something that the Shehbaz Sharif government will not be comfortable with.

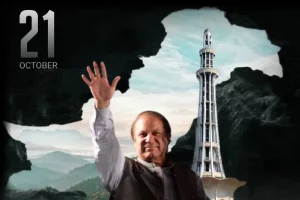

Former prime minister of Pakistan and Pakistan Tehreek-e-Insaaf attacked the government calling it “imported” comprising “crooks’ who came to power through US regime change conspiracy.

Also read: Pakistan in a bind: it urgently needs IMF funds but can't comply with the tough conditions

Pakistan's petrol price hike angers citizens, fuel protests by ousted Premier Imran Khan