India, which has often been hit by terror attacks, must carve out mechanisms to regulate crypto currencies amid the emerging payment and fund raising platforms along with wider usage of technology that have started fuelling global terrorism. As crypto currencies including bitcoins can be used anonymously traded between account holders across the world, concerns have risen among countries.

At a recently held event by the United Nations Security Council –Counter Terrorism Committee in the capital, members agreed to enhance cooperation on countering terrorism and adopt ways to monitor the use of new and emerging technologies for terrorist purposes.

India’s Permanent Representative to the UN Ambassador Ruchira Kamboj highlighted the CTC’s growing concern of the increase in use of new technologies for terrorist purposes as they become more accessible.

Navita Srikant, anti-corruption and forensic advisor, who was one of the speakers at the event told India Narrative that New Delhi should not shy away from accepting that crypto currencies are here to stay but it has the risk of increasingly being used for fuelling unlawful activities.

“We cannot turn a blind eye and it is imperative to come out with well thought out guidelines to regulate the cryptocurrencies and even track the flow and this needs to be taken up urgently.” Srikant said.

“Most countries are yet to take concrete steps to bring in national and cross border regulatory guidelines. To ensure effectiveness of the regulations all countries need to be on the same page,” she said.

A report by Chainalysis, a Singapore-based blockchain data platform, earlier this year revealed that several terror outfits including the Al-Qaeda, and ISIS have increased the usage for non state activities.

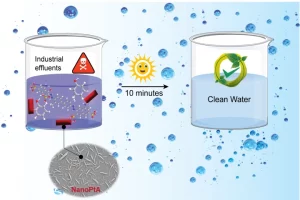

The Financial Action Task Force (FATF) earlier noted that virtual assets have made payments easier, faster, and cheaper while providing alternative methods for those without access to regular financial products. It added that without proper regulation, “they risk becoming a virtual safe haven for the financial transactions of criminals and terrorists.”

Meanwhile, Finance Minister Nirmala Sitharaman has indicated that framing guidelines for crypto assets would be given priority under India’s presidency for G20.

“No one single country can succeed individually, being in a silo, trying to regulate the crypto assets…we need to have all the members of the G20 first of all to come on board to see how best it can be done,” the Finance Minister said.

Also read: Debt distress, taxation, crypto regulation to be focus during India’s G20 presidency